280 Days ‘Til Bitcoin Booms (According to This Chart)

TL;DR

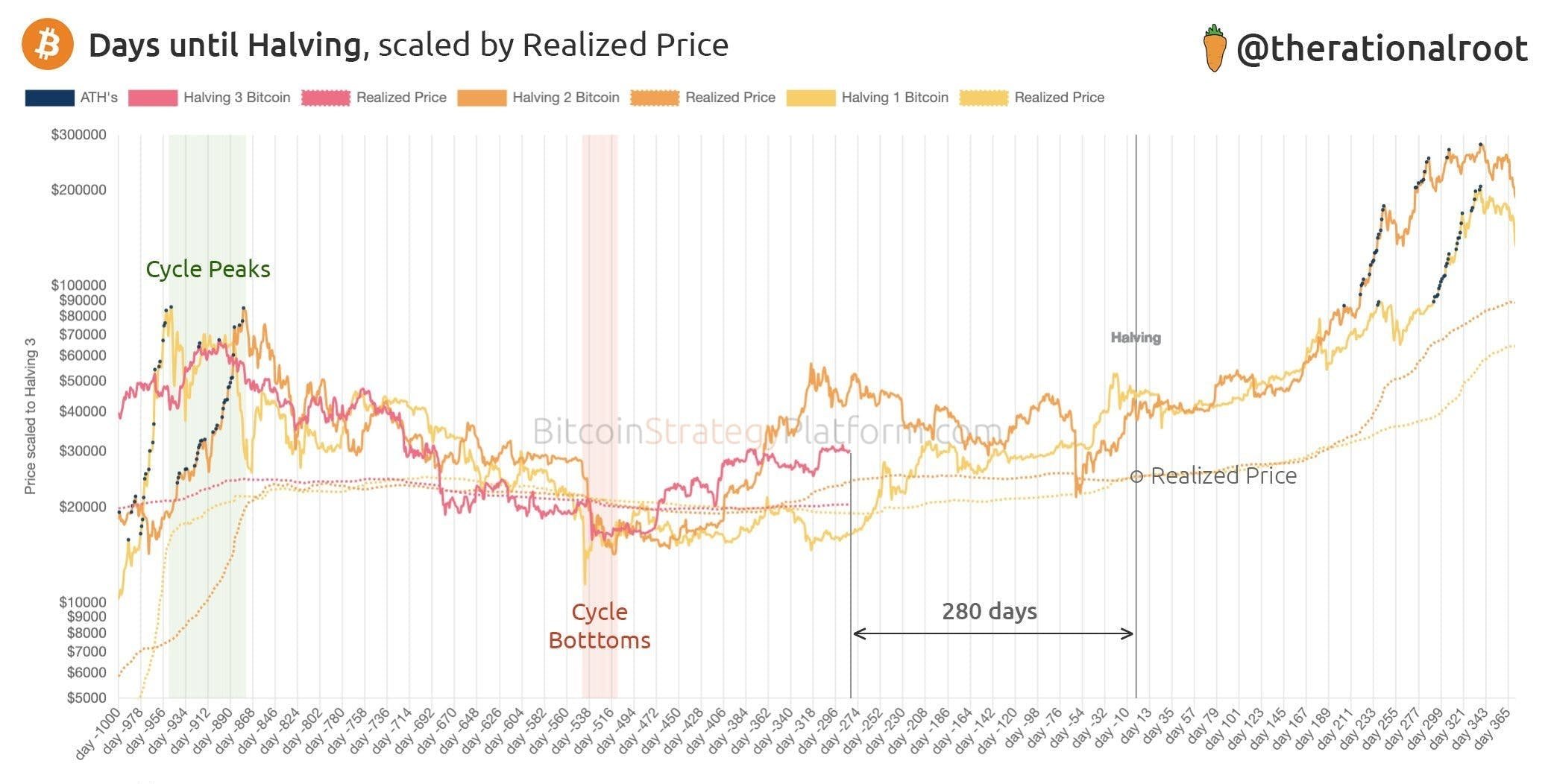

Twitter user @therationalroot has lumped each of the past 4 year Bitcoin halving cycles on top of each other in a single chart.

They show a consistent pattern that has repeated every four years, over the past ~11 years, which can give us insight into where BTC is headed in the next 12-24 months…

If these averages stay consistent this time around, we have a forecast of: 280 days of sideways trading, followed by 365 days of upward momentum. We love to see it!

Full Story

Bitcoin.

Love it or hate it, it has one function that unifies the entire crypto industry:

The halving cycle.

Every 4 years, the amount of new Bitcoin entering the market each day gets cut in half.

Which means as long as demand holds steady, there's a relatively dependable likelihood that the BTC price will go up.

(Demand + scarcity = value).

It unifies the crypto industry, because the rest of the market's prices tend to follow Bitcoin over longer time frames.

Right now, we're less than a year out from the next halving (280 days to be exact). So let's see where we're at, compared to previous cycles.

Twitter user @therationalroot has done the heavy lifting for us, lumping each of the past 4 year cycles on top of each other in a single chart.

For those of you that love consistency - brace yourselves - you might well up at this chart's beauty...

Alright, that's cool - but it's a little busy. Let's simplify things...

Are these averages perfect? No. We eye-balled em' and drew each one out using our meat bricks (hands) on a laptop trackpad.

But damn if they're not getting us excited for the future. If these past averages are followed this time around, we have a forecast of:

280 days of 'meh.'

Followed by 365 days of 'heeeeell yeah!'

As with all things in life: nothing is certain. Either way, we're liking this track record!