We're 75% of The Way to The Next BTC Halving Cycle (Here's What That Means)

Article source, here.

TL;DR

Every ~4 years, BTC becomes twice as hard to mine - and because there is a fixed supply of 21M BTC ever created, the 'Bitcoin halving cycle' historically coincides with the start of a bull run.

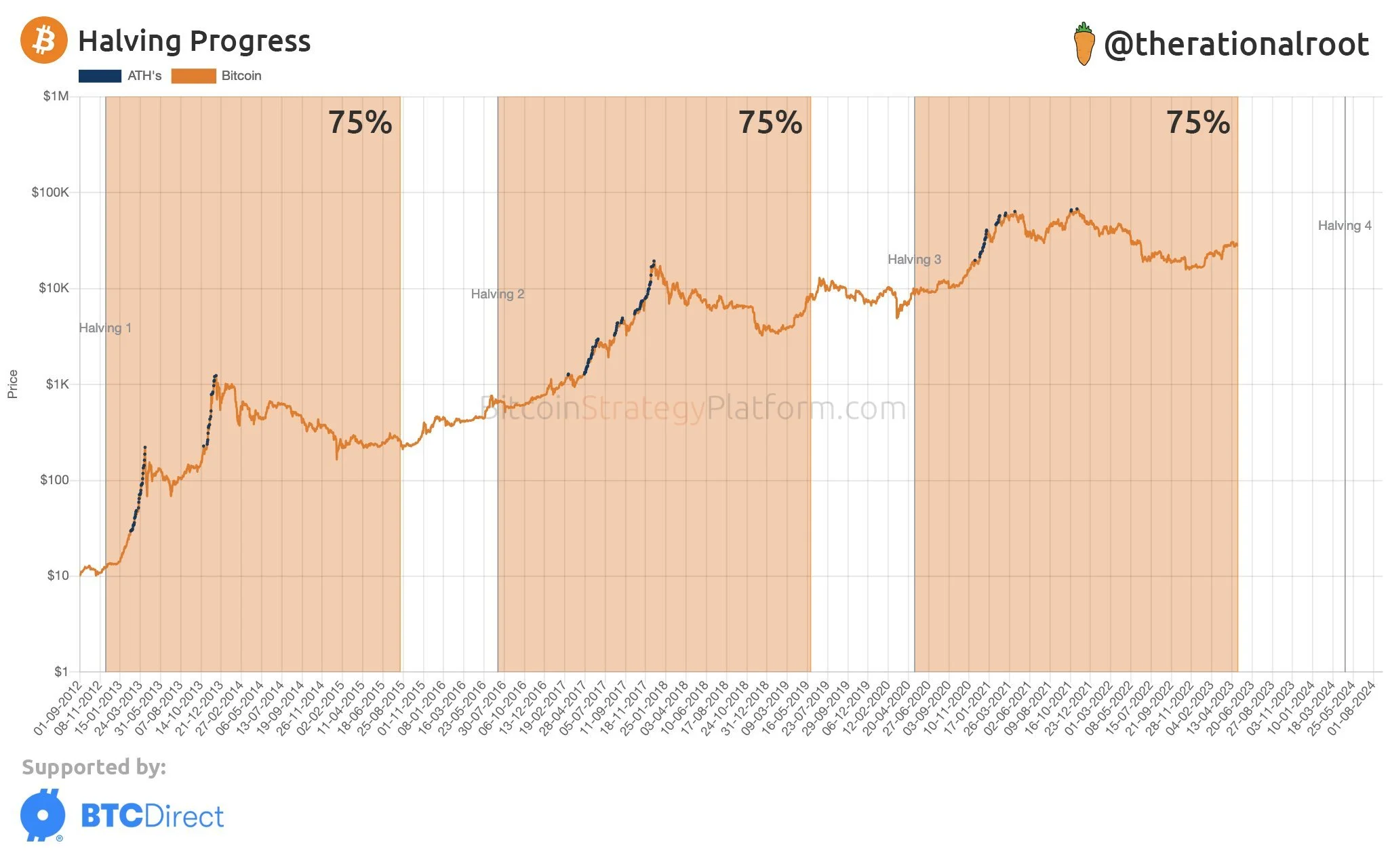

An analyst on Twitter put together a chart showing the status of the current Bitcoin cycle, and how it compares with the past ones at similar stages (seen below).

What we can say is that the BTC halving cycle is inevitable and there are typically more gains to be made following the 75% mark.

Full Story

Imagine a world where only 21 million M&M's were ever going to be made.

At first, you'd be able to get them at every street corner store. Heck, it'd be so easy to get your hands on them, most people wouldn't really care if they accidentally threw them away or lost them...

But then, every 4 years or so, half the shops selling M&M's would stop selling them.

M&M's would become way harder to find, making each chocolatey morsel more valuable, as time passed.

The above scenario is pretty damn theoretical! BUT it explains the Bitcoin halving cycle fairly well.

Every ~4 years, BTC becomes twice as hard to mine - and because there is a fixed supply of 21M BTC ever created, the 'Bitcoin halving cycle' has historically marked the start of a bull run.

(Demand + scarcity = people valuing it more).

As of this week, we're three quarters of the way to the next BTC halving.

An analyst on Twitter put together a chart showing the status of the current Bitcoin cycle, and how it compares with the past ones at similar stages.

*Note that the Y axis is on a logarithmic scale (thanks Ms. Zimbardo!)

Here's what this all means:

Okay, so, we're not technical analysts - and we're not here to tell you how to spend your money.

What we can say without our lawyer biting our heads off, is that the BTC halving cycle is inevitable and historically there's been more gains to be made following the 75% mark.

Let's hope we follow the same pattern this time around.